A firm is considering a new project. The project has 11 years’ life. This project requires initial investment of $150 million to purchase land, construct building, and purchase equipment, and $10 million for shipping & installation fee. The fixed assets fall in the 10-year modified accelerated cost recovery system (MACRS) class. The salvage value of fixed assets is $50 million. The number of units of the new product expected to be sold in the first year is 1,000,000 and the expected annual growth rate is 8%. The sales price is $200 per unit and the variable cost is $150 per unit in the first year, but they should be adjusted accordingly based on the estimated annualized inflation rate of 3%. The company is in the 40% tax bracket. The project’s discount rate is 8%.

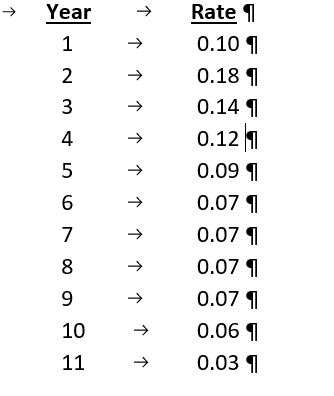

MACRS Rates

- Compute the depreciation basis and annual depreciation of the new project.

- Estimate annual cash flows for the 11 years.

- Draw a time line of the cash flows.

- What is the NPV of this project? Should the project be taken? Why?

Do you need urgent help with this or a similar assignment? We got you. Simply place your order and leave the rest to our experts.